Eleventh Circuit Court of Appeals Blocks Florida law that Discriminates based on National Origin

- At March 29, 2024

- By fhfla

- In News

0

0

The Eleventh Circuit Court of Appeals has temporarily halted the enforcement of an unconstitutional Florida law, known as SB 264, against two Chinese immigrants who have challenged the statute in court. SB 264 bans many Chinese immigrants, including people here as professors, students, employees, and scientists, from buying a home in large swaths of the state. This decision comes after a Florida district court ruled against the plaintiffs’ motion to preliminarily block the law while the case proceeded.

Judge Nancy Abudu acknowledged that “SB 264 was enacted for the specific purpose of targeting people of Chinese descent.” Judge Abudu concluded that the plaintiffs have shown a substantial likelihood that statute also violated the Equal Protection Clause of the United States Constitution. In doing so, Judge Abudu excoriated the District Court’s fraught reliance on the widely discredited century-old Terrace v. Thompson, 263 U.S. 197 (1923), case, determining that it “may have had support in 1923, but it is now 2024” and such laws are now subject to strict scrutiny.

Florida’s ban violates the U.S. Constitution by specifically targeting Chinese citizens, said Bethany Li, legal director of the Asian American Legal Defense and Education Fund, one of the groups representing the plaintiffs.

Leading Civil Rights and Consumer Advocates Urge the Biden-Harris Administration to Complete Its Important Work of Reforming the Home Valuation Process to End Appraisal Bias

- At March 29, 2024

- By fhfla

- In News

0

0

Washington, D.C. — As the Biden-Harris Administration’s Interagency Task Force on Property Appraisal and Valuation Equity (PAVE) marks the second anniversary of releasing its comprehensive Action Plan, the National Fair Housing Alliance® (NFHA™) and other leading civil rights and consumer advocates issued a statement commending the Administration for its leadership in organizing the first-ever interagency task force focused on addressing appraisal bias. The advocates also called on the PAVE Agencies to finish the job of reforming the home valuation process to end appraisal bias and to prevent harm to consumers and communities of color. The full statement reads:

“Recent research and news stories highlight how appraisal bias impacts consumers and communities of color and exacerbates the racial wealth gap. The need to continue reforming the appraisal process is urgent and immediate. We commend the PAVE Task Force for taking certain initial steps toward reform. To continue this important work, we strongly urge the PAVE Agencies to prioritize the following appraisal bias reform initiatives:

1. Resolve complaints. The U.S. Department of Housing and Urban Development (HUD) should resolve the over 160 consumer complaints alleging appraisal discrimination to provide relief to harmed consumers and a resolution for accused respondents.

2. Release appraisal data. To provide advocates, researchers, and industry insight into possible causes and harms of appraisal bias, the Federal Housing Finance Agency (FHFA), the Federal Housing Administration (FHA), the U.S. Department of Veterans Affairs (VA), and the U.S. Department of Agriculture (USDA) should release the uniform appraisal dataset to the public at the property level with appropriate protections for consumer privacy.

3. Issue examination procedures. The Consumer Financial Protection Bureau (CFPB), the Federal Deposit Insurance Corporation (FDIC), the Board of Governors of the Federal Reserve (FRB), the National Credit Union Administration (NCUA), and the Office of the Comptroller of the Currency (OCC) should issue examination procedures so examiners can supervise lenders and third-party appraisers for compliance with the Fair Housing Act and Equal Credit Opportunity Act with respect to potential appraisal discrimination.

4. Remove discriminatory barriers. The Appraisal Subcommittee (ASC) and its board should work with The Appraisal Foundation (TAF) to undertake a public, transparent review of each barrier to entry to the appraisal profession (including the Supervisory Appraiser requirement) to address the longstanding disparate impact resulting in a profession that is 95 percent White and 66 percent male.

5. Require appropriate fair housing training. The ASC and its board should work with TAF and the states to ensure that appraisers receive comprehensive and accurate fair housing training developed by fair housing experts.”

“Removing bias from the home valuation process strengthens individuals, families, communities, and the economy. All of us are harmed by practices that require Black and Latino families to ‘whitewash’ their homes to receive a fair and accurate appraisal. Fairness and accuracy in the home valuation process ensures consumers of color receive the dignity in the financial services marketplace that they deserve. We also know that we can grow the economy by $5 trillion over a five-year period just by addressing the discrimination that targets Black consumers. Completing the job will ensure people’s lives and communities are vibrant and they have access to the amenities necessary to thrive.”

This statement was issued jointly by the following organizations:

- National Fair Housing Alliance

- Community Works Consulting

- The Leadership Conference on Civil and Human Rights

- NAACP

- NAACP Legal Defense and Educational Fund, Inc.

- National Coalition for Asian Pacific American Community Development (National CAPACD)

- National Community Stabilization Trust (NCST)

- National Consumer Law Center (on behalf of our low-income clients)

- Neighborhood Housing Services of Chicago

- Prosperity Now

- UnidosUS

Justice Department, Federal Trade Commission, Consumer Financial Protection Bureau and Department of Housing and Urban Development Jointly Issue Resource on Protections for Rental Housing Applicants and Tenants

- At March 21, 2024

- By fhfla

- In News

0

0

The Justice Department, Federal Trade Commission (FTC), Consumer Financial Protection Bureau (CFPB) and Department of Housing and Urban Development (HUD) jointly published today a resource for rental housing applicants and tenants about their rights under federal laws related to tenant background checks, also referred to as tenant screening reports. The Justice Department and HUD enforce the Fair Housing Act (FHA) and other civil rights statutes, and the FTC and CFPB enforce the Fair Credit Reporting Act (FCRA).

“Rental housing applicants and tenants across our country should not be denied housing opportunities because of unjust background checks and discriminatory screening policies,” said Assistant Attorney General Kristen Clarke of the Justice Department’s Civil Rights Division. “Landlords and background check companies cannot use or ask for unnecessary information to deny someone housing. Today we are shining a light on the bad practices that can emerge when landlords maintain unjust screening policies, ensuring that applicants and tenants know their rights, and that housing providers and background check companies are on notice regarding their obligations under federal law.”

“Mistakes in your background check shouldn’t cost you a home or create one more hurdle to overcome as you search for affordable housing,” said Director Samuel Levine of the FTC’s Bureau of Consumer Protection. “This collaboration among FTC, CFPB, HUD and the Justice Department helps consumers know their rights, and what to do if landlords or background check companies break the law.”

“Tenants have rights when landlords deny housing based on tenant screening reports,” said CFPB Director Rohit Chopra. “These reports often rely on hidden data and complex algorithms and can cause serious harm to families seeking housing. Anyone who thinks they were wrongly denied housing because of a tenant screening report can file a complaint with the CFPB.”

“People seeking housing have a right to be free from discrimination, including during the tenant screening process,” said HUD Principal Deputy Assistant Secretary for Fair Housing and Equal Opportunity Demetria McCain. “HUD is excited to be a part of the release of this joint agency resource that contains important information about the Fair Housing Act’s protections against discriminatory background checks. We encourage anyone who suspects they are being discriminated against to file a complaint with HUD.”

The new resource provides information about how tenant background checks work, what kinds of background information a landlord might receive from tenant background check companies, how applicants and tenants can respond if they think that information is wrong and their rights under federal laws.

It also explains that, in some instances, tenant background checks can lead to illegal discrimination, even if there is no factual error in the report. The FHA makes it illegal for tenant background check companies and housing providers to discriminate against individuals on the basis of race, national origin, color, sex, religion, disability or familial status. A landlord cannot reject an application or treat an applicant or tenant differently than other applicants or tenants because of any of these characteristics. Actions of a tenant background check company or a landlord can also be illegal if they use or encourage the use of irrelevant or unnecessary information to deny individuals housing, and this negatively affects some groups more than others – this may be discrimination even if the tenant background check company or landlord does not intend to discriminate.

The resource also explains an individual’s rights under the FCRA, including the right to request a free copy of a report from the tenant background check company if a landlord makes a negative housing decision because of something included in the report and the right to dispute errors on a report. Tenant background check companies are required to take reasonable steps to ensure the information in tenant background check reports is accurate and to investigate within 30 days when someone disputes errors in their report.

Individuals who believe they have been victims of housing discrimination can submit a report to the Justice Department online at www.civilrights.justice.gov. Such individuals also may contact HUD at 1-800-669-9977 or file a complaint with HUD online.

Individuals can submit a report to the FTC in English at ReportFraud.ftc.gov or in Spanish at ReporteFraude.ftc.gov. To submit a report to the FTC in other languages, call (877) 382-4357 and press 3 to speak to an interpreter in your language. Lines are open from 9 a.m. to 5 p.m. ET.

Individuals can submit a complaint to the CFPB online or call the CFPB at (855) 411-2372 | TTY/TDD: (855) 729-2372 from 8 a.m. to 8 p.m. ET, Monday through Friday (except federal holidays). Help by phone is available in more than 180 languages.

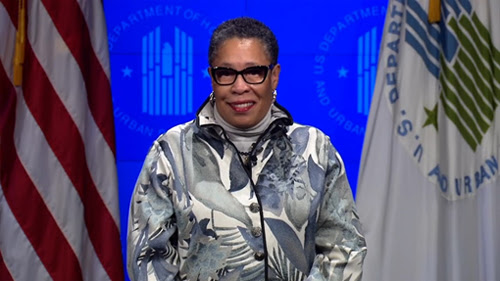

National Fair Housing Alliance Issues Statement Saluting Secretary Fudge’s Significant Leadership following Announcement of her Retirement and Resignation as HUD Secretary

- At March 11, 2024

- By fhfla

- In News

0

0

Today, Lisa Rice, President and CEO of the National Fair Housing Alliance (NFHA™), issued the following statement on the announced retirement and resignation of U.S. Department of Housing and Urban Development Secretary, Marcia L. Fudge.

“With tremendous gratitude, we at NFHA acknowledge the resignation of Secretary Marcia L. Fudge from her role as the head of the Department of Housing and Urban Development (HUD). Secretary Fudge has been a tireless advocate for fair housing and a champion for equitable urban and rural development throughout her distinguished career, making significant strides in advancing HUD’s mission. As a lawyer and former member of Congress from Ohio, Secretary Fudge brought a wealth of experience, passion, and a resolute commitment to advancing fair housing in her leadership of HUD and has been instrumental in shaping policies aimed at fostering vibrant, inclusive communities that provide all people with the resources and amenities necessary to thrive. Under Secretary Fudge’s leadership, HUD took many important actions, including the following pivotal steps:

- Worked with Congress to restore HUD’s staffing and resources as the agency was gutted under the former administration as well as shoring up funding to enable the Office of Fair Housing and Equal Opportunity to be effective.

- Partnered with Vice President Harris in establishing and co-led the first of its kind interagency task force on Property Appraisal and Valuation Equity (PAVE) with a goal of ending bias in home valuations.

- Steered the Biden-Harris Administration in confirming fair-housing committed nominees to serve as the heads of the Federal Housing Finance Agency, Ginnie Mae, and Federal Housing Administration. This is the first time in history that these agencies were all led by women leaders at the same time. Secretary Fudge also appointed noted fair housing movement attorney, Demetria McCain, as the Principal Deputy Assistant Secretary for Fair Housing and Equal Opportunity (FHEO).

- Restored critical fair housing rules such as the Restoring HUD’s Discriminatory Effects Standard Rule (Final Rule), which rescinds HUD’s 2020 rule governing Fair Housing Act disparate impact claims and restores the 2013 discriminatory effects rule. This action reinstated a key fair housing rule to advance justice and fairness for all. HUD also sent its final Affirmatively Furthering Fair Housing (AFFH) rule to the Office of Budget and Management for its review. The AFFH proposed rule is poised to be a viable tool in helping jurisdictions increase the supply of fair and affordable housing and ensure every community is resourced with the amenities people need to thrive.

- Issued precedent-setting guidance clarifying that Special Purpose Credit Programs, implemented properly and in accordance with the Equal Credit Opportunity Act, do not violate the Fair Housing Act. This guidance helped open the doors for thousands of creditworthy consumers to be assessed for mortgage credit based on their rental housing payment history and other sound underwriting criteria.

- Ensured HUD’s rules and regulations centered equity and the responsibility to ensure federal housing and community development funding is used to create vibrant communities for everyone, which has assisted millions of people of color, women, people with disabilities, families with children, LGBTQ+ persons and more with fairer rental and homeownership opportunities.

- Worked with the Congress to secure necessary funding for local fair housing enforcement agencies to conduct the important work of continuing to be the first responders combatting over 4 million incidences of discrimination annually.

We extend our heartfelt gratitude to Secretary Fudge for her strong leadership, deep compassion, dedicated service and unwavering commitment to the American people and the principles of fairness and justice. Her legacy will undoubtedly continue to inspire our ongoing efforts to promote fair housing and build inclusive, vibrant, well-resourced communities. On behalf of the National Fair Housing Alliance, I want to express our deepest appreciation to Secretary Fudge for her impactful contributions to the advancement of fair housing and civil rights. We wish her the very best in her well-deserved retirement, confident that her influence will endure as we strive to create a more just and equitable future for all.

We also look forward to continuing to partner with HUD Deputy Secretary Todman in her new role as HUD’s Acting Secretary. Like Secretary Fudge, Deputy Secretary Todman is a true champion for fair housing.”

The National Fair Housing Alliance (NFHA) is the country’s only national civil rights organization dedicated solely to eliminating all forms of housing and lending discrimination and ensuring equal opportunities for all people. As the trade association for over 170 fair housing and justice-centered organizations and individuals throughout the U.S. and its territories, NFHA works to dismantle longstanding barriers to equity and build diverse, inclusive, well-resourced communities.