Wells Fargo Bank agrees to pay $42 million

- At July 03, 2013

- By fhfla

- In News

0

0

Wells Fargo Bank agreed to pay $42 million to settle a complaint that it failed to maintain foreclosed properties in minority neighborhoods, turning the vacant houses into dilapidated eyesores.

Wells Fargo Bank agreed to pay $42 million to settle a complaint that it failed to maintain foreclosed properties in minority neighborhoods, turning the vacant houses into dilapidated eyesores.

The National Fair Housing Alliance and member organizations sued Wells Fargo in April 2012, alleging in an administrative complaint filed with the U.S. Department of Housing and Urban Development that the bank violated the Fair Housing Act.

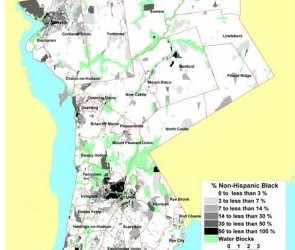

The complaint alleged Wells Fargo’s so-called “real estate owned” properties in white areas were much better maintained and marketed than the properties in African-American and Latino neighborhoods. For example, houses in minority areas often had ill-kept yards, broken doors, peeling paint or boarded-up windows.

“Many neighborhoods across the country have been seriously damaged by the foreclosure crisis, including the impact of [real estate owned] homes on property values, curb appeal, and tax revenue for schools,” said Shanna Smith, head of the National Fair Housing Alliance. “Our joint efforts will help lay the foundation for the industry to get some of those neighborhoods back on their feet.”

The housing groups filed similar complaints against Bank of America and U.S. Bancorp, which are still pending.

Wells Fargo—represented by Skadden, Arps, Slate, Meagher & Flom partners Anand Raman and Joseph Barloon, who are both based in Washington—is the first to settle.

According to the plaintiffs, who turned to Joseph Sellers and Peter Romer-Friedman of Cohen Milstein Sellers & Toll, it’s the first-ever agreement regarding the equal maintenance and marketing of bank-owned homes.

Wells Fargo agreed to provide $27 million to the fair housing organizations to promote home ownership, property rehabilitation and development in 19 communities of color, including areas of Baltimore, Washington D.C. and Prince George’s County, Md.

Another $3 million goes to the housing organizations to cover costs and attorney fees. The bank will also pay HUD $11.5 million to support neighborhoods in an additional 25 cities.

South Florida Developer agrees to retrofit thousands of local apartments to settle federal disabilities lawsuit

- At April 01, 2013

- By fhfla

- In News

0

0

In a move advocates for the disabled heralded as a major step in efforts to make sure handicapped people have places to live, a leading South Florida builder has agreed to retrofit an estimated 5,000 units — including scores in Palm Beach County — with grab bars, ramps and other features so they are accessible to people in wheelchairs or who have other physical limitations.

In a move advocates for the disabled heralded as a major step in efforts to make sure handicapped people have places to live, a leading South Florida builder has agreed to retrofit an estimated 5,000 units — including scores in Palm Beach County — with grab bars, ramps and other features so they are accessible to people in wheelchairs or who have other physical limitations.

Cornerstone Group Development Corp. agreed to make the improvements at more than 50 of its apartment complexes statewide, including The Preserve at Boynton Beach and Renaissance Apartments in West Palm Beach. The flurry of construction activity will settle a 2011 lawsuit filed against it by the National Fair Housing Alliance and the Greenacres-based Coalition for Independent Living Options.

In addition, the Hollywood-based developer agreed to pay the two groups $1.35 million and establish a fund to help disabled people anywhere in the state make their homes more accessible.

“It’s a huge, huge settlement agreement,” said Genevieve Cousminer, executive director of the coalition that is dedicated to helping disabled people live on their own. “There’s so little (accessible housing) available, so when a developer is building apartment complexes and representing that they are accessible, they really should be.”

Read More»HUD Threatens to Reallocate $7.4mm of Westchester County Funding

- At April 01, 2013

- By fhfla

- In News

0

0

Westchester County stands to lose an estimated $7.4 million in federal HUD funding for failing to comply with the terms of the Fair and Affordable Housing Settlement. In a letter to County Executive Rob Astorino dated March 25, 2013, HUD Director of Planning and Development Vincent Hom chides the county for failing to provide “a satisfactory plan to overcome exclusionary zoning practices” or providing a plan to promote sources of income legislation that would bar landlords from discriminating against tenants who use Section 8 vouchers or other government income to pay their rent.

Westchester County stands to lose an estimated $7.4 million in federal HUD funding for failing to comply with the terms of the Fair and Affordable Housing Settlement. In a letter to County Executive Rob Astorino dated March 25, 2013, HUD Director of Planning and Development Vincent Hom chides the county for failing to provide “a satisfactory plan to overcome exclusionary zoning practices” or providing a plan to promote sources of income legislation that would bar landlords from discriminating against tenants who use Section 8 vouchers or other government income to pay their rent.

A silent crisis for senior citizens in Florida

- At March 19, 2013

- By fhfla

- In News

1

1

PALM BEACH COUNTY, Fla. – PALM BEACH COUNTY, Fla. — Years-long waiting lists for affordable housing and a decline in the returns of personal investments has led to a silent crisis for senior citizens in Florida, the president of the Florida Alliance for Retired Americans warned on Friday. Tony Fransetta, the FARA president, predicted the problem would get worse as more of us aged.

By 2030, he said, one in five Americans would be over 55-years-old.