Federal Lawsuit Filed Against Fontana Properties Condominium Association & RPH Property Management

- At July 26, 2018

- By fhfla

- In News

0

0

The Fair Housing Center of the Greater Palm Beaches has filed a federal lawsuit against Fontana Properties Condominium Association, Elizabeth Hardwick, President, RPH Property Management of Palm Beach, Inc and Richard P. Hallet, RPH Director.

This FHC enforcement action seeks declaratory judgment, preliminary and injunctive relief, damages and a Victims Fund for discrimination on the basis of familial status in the provision of housing. “This lawsuit serves as a warning to all those who are harming our children, our families and our communities 50 years after the signing of the Fair Housing Act. The FHC and our partners will hold you accountable” stated Bobbie Fletcher, FHC Vice President.

Federal Lawsuit Filed by FHC and 19 Fair Housing Groups Against Bank of America for Violating the Federal Fair Housing Act

- At June 27, 2018

- By fhfla

- In News

0

0

The Fair Housing Center of the Greater Palm Beaches (FHC) has joined the National Fair Housing Alliance (NFHA), 18 fair housing organizations, and two homeowners in Maryland in filing a federal Fair Housing Act lawsuit against Bank of America, N.A., Bank of America Corp., , and Safeguard Properties Management, LLC (“Bank of America/Safeguard”). The lawsuit alleges Defendants intentionally failed to provide routine exterior maintenance and marketing at Bank of America-owned homes in working- and middle-class African-American and Latino neighborhoods in 37 metropolitan areas, while they consistently maintained similar bank-owned homes in comparable white neighborhoods.

The data presented in the federal lawsuit, which is supported by substantial photographic evidence, shows a glaring pattern of discriminatory conduct by Bank of America/Safeguard. More than 35,000 photos document the relevant routine exterior maintenance conditions of the homes. In neighborhoods of color, Plaintiffs found evidence of consistently poor exterior maintenance, such as wildly overgrown grass and weeds, unsecured doors and windows, damaged steps and handrails, accumulated trash and debris, unsecured pools, graffiti, and even dead animals decaying in yards. Plaintiffs investigated more than 1,600 Bank of America-owned homes in working- and middle-class white, African-American, and Latino neighborhoods. The lawsuit alleges that Bank of America-owned homes in predominantly white working- and middle-class neighborhoods are far more likely to have the lawns mowed and edged regularly, invasive weeds and vines removed, windows and doors secured or repaired, debris and trash removed, leaves raked, and graffiti erased from the property. Bank of America took possession of these homes after it foreclosed on the properties and became the owner of record. As owner of these homes, Bank of America is responsible for routine exterior maintenance on all of its properties.

This lawsuit is the result of a multi-year investigation undertaken by NFHA and its fair housing agency partners. In June 2009, NFHA notified Bank of America of maintenance problems that appeared to violate the Fair Housing Act. NFHA met with Bank of America officials for more than a year and offered recommendations to ensure proper treatment of its homes in communities of color. However, after seeing absolutely no improvement in routine exterior maintenance of Bank of America-owned homes in communities of color, NFHA began a multi-year, multi-city systemic investigation. Bank of America was put on notice multiple times since 2009, including the filing of a HUD housing discrimination complaint against it and publication of three reports documenting the nationwide problem of poor maintenance of bank-owned homes in communities of color.

Two Maryland homeowners joined this federal discrimination lawsuit because of Bank of America’s failure to maintain and secure homes next to theirs. The lawsuit claims Ms. Wanda Onafuwa and Ms. Chevelle Bushnell and her son, Jalen Bushnell, suffered not only physical damage to their townhomes, but also experienced emotional harm from living next to unsecured, unmaintained, vacant homes. Because Bank of America and Safeguard failed to secure the homes, unauthorized people entered the homes repeatedly over many months, causing damage to Ms. Onafuwa and Ms. Bushnell’s property.

Ms. Onafuwa has owned her home in Baltimore for 23 years, and Ms. Bushnell has owned her home in District Heights for 28 years. They had never had rodent problems or squatters in their neighborhoods until Bank of America/Safeguard failed to secure and maintain its foreclosed homes adjacent to their properties. Ms. Onafuwa and her neighbors battled a rat infestation at Bank of America’s home in her neighborhood, as well as a squatter. Ms. Onafuwa reported the various problems many times to Bank of America and Safeguard to no avail. She and her neighbors finally got the City of Baltimore involved to evict the squatter, tear down the rat-infested garage, and secure Bank of America’s home.

Ms. Bushnell battled squirrels in her attic when Bank of America/Safeguard failed to board holes in the roof of its property. In addition, after Bank of America sent a foreclosure notice to the homeowners, they vacated the property. Bank of America allowed the property to sit vacant and did not process the official foreclosure notice for several years. As a result, the property looked abandoned and was vandalized several times. During this time period, the Bushnells’ home was broken into when thieves knocked a hole in the wall between the vacant home next door and Ms. Bushnell’s bedroom and then ransacked her home while she was at work.

She had to report this damage to her insurance company, repair her home, and buy an alarm system and security doors to protect herself and her son. When Bank of America finally took ownership of the home, the Bank/Safeguard continually failed to secure the house, which allowed people to enter the townhome at will and caused Ms. Bushnell and her son great distress, due to their previous experience.

“Bank of America and Safeguard’s deplorable and intentional inaction left innocent homeowners exposed to numerous health hazards and personal risks. No one should have to live like this due to Bank of America’s failure to maintain its own properties,” said Lisa Rice, President and CEO of NFHA. “NFHA and the co-plaintiffs filed this lawsuit to make sure that these discriminatory practices come to an end and that perpetrators like Bank of America are held responsible for their unjust policies and practices,” Rice continued.

The poor appearance of Bank of America-owned homes in middle- and working-class neighborhoods of color destroys the homes’ curb appeal for prospective owner-occupant buyers and invites vandalism because the homes appear to be abandoned. Additionally, the blight created by Bank of America/Safeguard results in a decline in home values for African American and Latino families who live next door or nearby, deepening the racial wealth gap and inequality in America.

Ms. Rice further said, “Bank of America and Safeguard’s intentional failure to correct their discriminatory treatment in African American and Latino neighborhoods—the same communities hardest hit by the foreclosure crisis—is systemic racism. The purposeful neglect of bank-owned homes in communities of color devalues the properties and the lives of the families in the neighborhoods around them. The health and safety hazards created by these blighted bank-owned homes negatively affect the residents, especially the children, living nearby. We have asked Bank of America and Safeguard to provide the same standard of routine exterior maintenance and marketing for all of its bank-owned homes, regardless of the age, value, or racial composition of the neighborhood in which they are located.”

“Fifty years after the signing of the historic Fair Housing Act and here in Palm Beach County we have what amounts to a thievery of momentous proportions ever seen. Whole communities of middle class black and Latina homeowners striped of their wealth” stated Vince Larkins, FHC President and CEO. “This lawsuit is a clear message that the FHC and our partners will continue to fight on to protect our communities from violations of the Fair Housing Act and make them whole” he further stated.

The investigation documented 37 objective aspects of routine exterior maintenance that are common factors used in the preservation maintenance industry. Plaintiffs recorded deficiencies such as overgrow lawns, accumulated litter, trash and debris in yards, broken and boarded windows, unlocked doors and windows, graffiti, unsecured pool gates, lack of for-sale signs and discarded signs in bushes, and obstructed gutters and missing downspouts, among other items that are necessary for property preservation.

Nationwide, the data shows that:

- 45 percent of the Bank of America properties in communities of color had 10 or more maintenance or marketing deficiencies, while only 11 percent of the Bank of America properties in predominantly white neighborhoods had 10 or more maintenance or marketing deficiencies.

- 64 percent of the Bank of America properties in communities of color had trash or debris visible on the property, while only 31 percent of the Bank of America properties in predominantly white neighborhoods had trash visible on the property.

- 37 percent of the Bank of America properties in communities of color had unsecured or broken doors, while only 16 percent of the Bank of America properties in predominantly white neighborhoods had unsecured or broken doors.

- 49.6 percent of the Bank of America properties in communities of color had damaged, boarded, or unsecured windows, while only 23.5 percent of the Bank of America properties in white neighborhoods had damaged, boarded or unsecured windows.

Local data shows that:

In the Greater Palm Beaches, FL metropolitan area, Plaintiffs investigated 25

Bank of America REO properties. Of these 25 REO properties, 2 were located in

African-American neighborhoods, 3 were located in predominantly Latino

neighborhoods, 8 were located in predominantly non-white neighborhoods, and 12 were

located in predominantly white neighborhoods.

- 33.3% of the REO properties in predominantly white neighborhoods had

fewer than 5 maintenance or marketing deficiencies, while none of the REO

properties in neighborhoods of color had fewer than 5 maintenance or

marketing deficiencies.

- 100% of REO properties in neighborhoods of color had 5 or more marketing

or maintenance deficiencies, while only 66.7% of the REO properties in white

neighborhoods had 5 or more marketing or maintenance deficiencies.

- 53.8% of REO properties in neighborhoods of color had 10 or more marketing

or maintenance deficiencies, while only 8.3% of the REO properties in white

neighborhoods had 10 or more marketing or maintenance deficiencies.

REO properties in neighborhoods of color were far more likely to have certain

types of deficiencies or problems than REO properties in predominantly white

neighborhoods. Plaintiffs found significant racial disparities in the majority of the

objective factors they measured, including the following:

- 76.9% of the REO properties in neighborhoods of color had substantial

amounts of trash or debris on the premises, while only 50.0% of the REO

properties in predominantly white neighborhoods had the same problem.

- 46.2% of the REO properties in neighborhoods of color had overgrown grass

or dead leaves, while only 41.7% of the REO properties in predominantly

white neighborhoods had the same problem.

- 46.2% of the REO properties in neighborhoods of color had overgrown or

dead shrubbery, while only 41.7% of the REO properties in predominantly

white neighborhoods had the same problem.

- 33.8% of the REO properties in neighborhoods of color had at least 10% to

50% of the property covered in dead grass, while only 16.7% of REO

properties in predominantly white neighborhoods had the same problem.

- 33.8% of the REO properties in neighborhoods of color had 50% or more of

the property covered in dead grass, while none of REO properties in

predominantly white neighborhoods had the same problem.

- 76.9% of the REO properties in neighborhoods of color had unsecured,

boarded, or broken doors, while only 50.0% of the properties in

predominantly white neighborhoods had the same problem.

- 53.8% of the REO properties in neighborhoods of color had broken or

boarded windows, while only 41.7% of the REO properties in predominantly

white neighborhoods had the same problem.

- 15.4% of the REO properties in neighborhoods of color had a damaged roof,

while none of the REO properties in predominantly white neighborhoods had

the same problem.

- 61.5% of the REO properties in neighborhoods of color had a damaged fence,

while only 25.0% of the REO properties in predominantly white

neighborhoods had the same problem.

- 23.1% of the REO properties in neighborhoods of color had holes in the

structure of the home, while none of the REO properties in predominantly

white neighborhoods had the same problem.

- 42.2% of the REO properties in neighborhoods of color had wood rot, while

only 25.0% of the REO properties in predominantly white neighborhoods had

the same problem.

- 23.1% of the REO properties in neighborhoods of color had signs marketing

the home as a distressed property, while none of the REO properties in

predominantly white neighborhoods had the same problem.

- 76.9% of the REO properties in neighborhoods of color had no professional

“for sale” sign marketing the home, while only 58.3% of the REO properties

in predominantly white neighborhoods had the same problem.

- 36.5% of the REO properties in neighborhoods of color had peeling or

chipped paint, while none of the REO properties in predominantly white

neighborhoods had the same problem.

- 23.1% of the REO properties in neighborhoods of color had damaged siding,

while only 8.3% of the REO properties in predominantly white neighborhoods

had the same problem.

- 15.4% of the REO properties in neighborhoods of color had missing or

damaged shutters, while only 8.3% of the REO properties in predominantly

white neighborhoods had the same problem.

- 38.5% of the REO properties in neighborhoods of color had pervasive mold,

while only 33.3% of the REO properties in predominantly white

neighborhoods had the same problem.

- 76.9% of the REO properties in neighborhoods of color had exposed or

tampered-with utilities, while only 8.3% of the REO properties in

predominantly white neighborhoods had the same problem.

Click here to view Bank of America Complaint

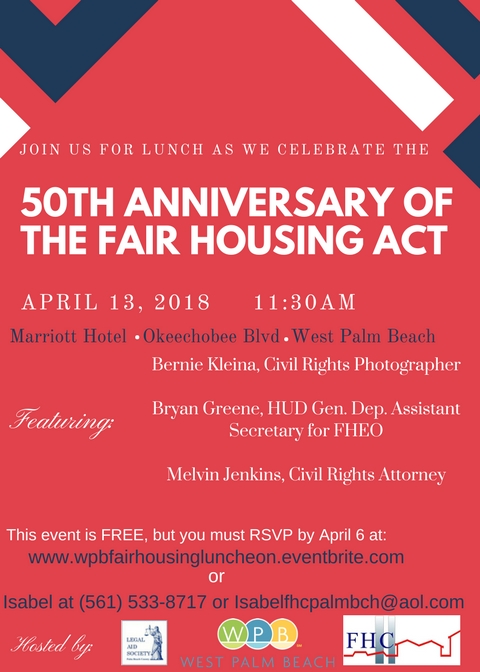

Join Us in Celebrating the 50th Anniversary of the Signing of Historic Fair Housing Act of 1968!

- At March 27, 2018

- By fhfla

- In News

0

0

FHC Files Federal Lawsuit against Boynton Beach Apartment Complex to Open Units to Families with Kids

- At February 21, 2018

- By fhfla

- In News

0

0

The Fair Housing Center of the Greater Palm Beaches, Inc. (FHC) today filed a federal lawsuit against Alan Beigel, owner of BB Apartments, located in the City of Boynton Beach, Florida and Deondria L. Ammons, the property manager.

The FHC suit alleges that the Defendants discriminate in the rental of housing on the basis of familial status (presence of minor children under 18), in violation of the federal Fair Housing Act of 1968, as amended.

The suit arises as a result of an FHC testing investigation, which showed that homeseekers with children were treated differently from homeseekers without children. BB Apartments is not designated for older persons fifty-five (55) years of age or older and therefore is not exempt from the Fair Housing Act.

This FHC’s enforcement action seeks declaratory judgment, preliminary and injunctive relief, and damages for discrimination on the basis of familial status in the provision of housing. This action arises under Title VIII of the Civil Rights Act of 1968, as amended (“Fair Housing Act”).

“In a day and age when good, decent and safe affordable housing is very difficult to find, it is absolutely critical that families with children be protected”, stated Vince Larkins, FHC President/CEO. “The FHC and our partners will continue to work hard to keep the doors to affordable housing units open to our kids in Palm Beach County and the State of Florida”, he added.

The plaintiffs are represented by FHC Cooperating Attorney Maxine Cheesman Esq. of the Law Offices of Maxine D. Cheesman, P.A. in West Palm Beach, Fla.

Anyone who believes they have been discriminated against at BB Apartments may contact the FHC’s toll-free hotline at 1-877-910-FAIR.